Survey: Study on America's Relationship With Money

The team here at NoDepositRewards.org recently surveyed 6,000 people across the United States, asking what they’d do with an unexpected $1 million. Would they give it to charity, gamble it, or stash it for a rainy day? The results reveal how Americans think about money, risk, and relationships. From the charity-driven South to the practical Midwest, the findings certainly give us an entertaining peek into regional attitudes toward sudden wealth.

But how do we look as a whole?

Advertiser Disclosure

By accessing and depositing through our provided links, we may receive a commission at no extra cost to you. Learn More.

✖How We Rank Casino Bonuses using BonusRank

Not just any online casino makes the grade. We have a strict process for testing online casinos to determine whether we even list them.

Once we approve a casino, our team of experts starts the real work. And it's thorough. Our unique BonusRank algorithm considers all the important aspects of a bonus and calculates a score that allows meaningful and direct comparison between bonuses. You don't have to guess, our rating scale will clearly show you if a bonus is great, good enough, or should be avoided.

Read more about our BonusRank system and how we make bonus comparisons.

✖Across America: How We Handle $1 Million

Before we dig into regional quirks, let’s take a look at the overall numbers. The national results tell us a lot about Americans’ general attitudes toward sudden wealth, offering insights that may surprise you.

- Charity - 55% said they’d give a portion of the money to charity, which translates to roughly 183 million people, while 45% (about 150 million people) would keep every cent.

- Sharing with a Partner - With a near-even split, 49% (around 163 million people) said they’d expect half if their partner won a million, while 51% (about 170 million people) wouldn’t. Surely it isn’t worth the hassle of the arguments!

- Take a Risk on a Punt - 47% would risk it, about 177 million people, while 53% (approximately 157 million people) would play it safe. Can’t believe how daring some are!

- Importance of Money - For 45% (about 150 million people), money is essential, while 55% (around 183 million people) don’t consider it to be a priority. Must be nice eh!

- Happiness vs. Wealth - When asked if they’d rather be an unhappy billionaire, 55% (or around 183 million people) would choose wealth, while 44.7% (roughly 149 million people) would opt for a happy, middle-class lifestyle.

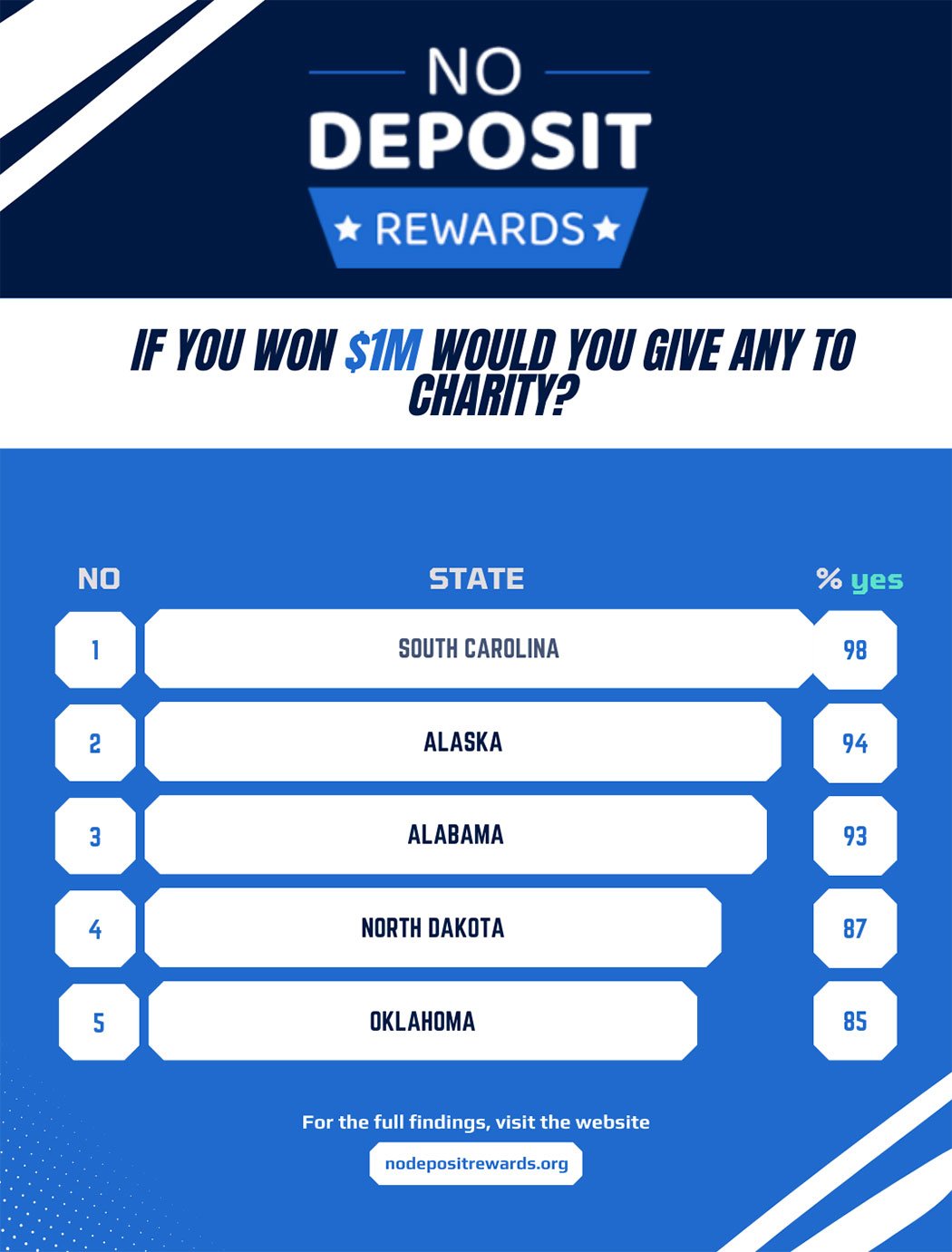

Charity or Keep it All?

Most Charitable: South Carolina (98% Yes)

South Carolina leads the pack, with 98% saying they’d give part of their million to charity. Known for Southern hospitality, South Carolinians seem to see wealth as an opportunity to uplift their communities. From local charities to faith-based organizations, it’s likely that much of this generosity would stay close to home. For people in South Carolina, giving seems to be part of the fabric of life, as natural as sweet tea and summer barbecues.

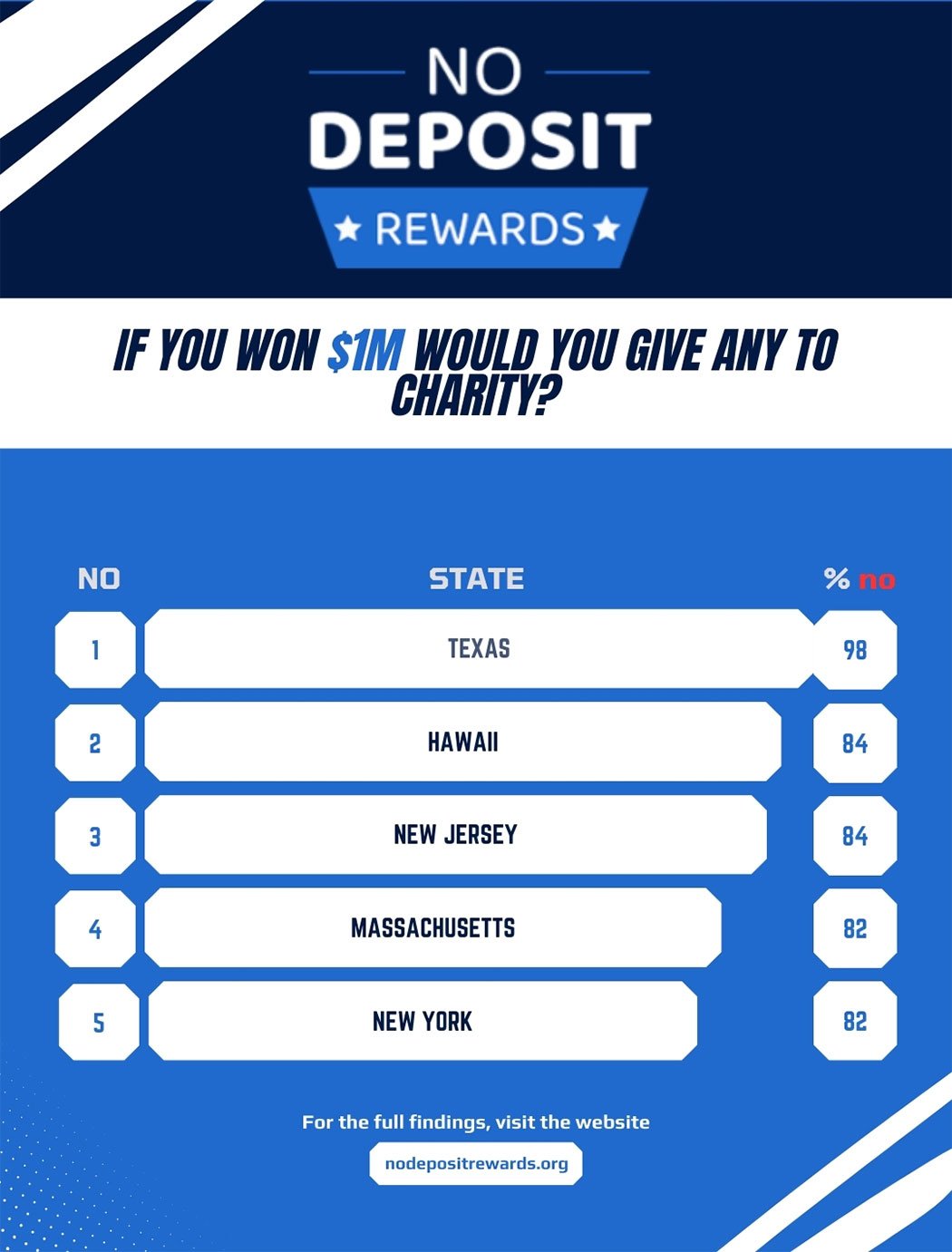

Least Charitable: Texas (98% No)

In contrast, 98% of Texans opted to keep their million for themselves. Texans are famous for their pride and independence, so it’s no surprise that they’d be inclined to prioritize personal or family needs. With the state’s rugged individualism and “go big or go home” mindset, Texans seem to view sudden wealth as something to secure their own futures rather than distribute it to others.

These regional differences reflect not just personal choices, but the values that have shaped each state’s identity over time. While Texans might be focused on building a financial legacy, South Carolinians are all about spreading the wealth.

If Your Partner Won $1 Million, Would You Expect Half?

This section could certainly provoke some heated discussions…When it comes to relationships, money can be a tricky subject. In some states, financial transparency is part of the package. In others, people prefer to keep things separate.

Most Likely to Expect Half: Colorado (94% Yes)

Colorado led the way, with 94% saying they’d expect to share in their partner’s windfall. In a state known for its progressive values and emphasis on equality, it’s clear that Coloradans see relationships as partnerships in every sense of the word. Here, “what’s mine is yours” seems to be more than just a saying.

Least Likely to Expect Half: Minnesota (97% No)

In Minnesota, however, 97% of respondents said they wouldn’t expect a penny. Perhaps it’s the famed Minnesota “niceness” or the Scandinavian influence that makes Minnesotans fiercely independent. Whatever the reason, Minnesotans seem content to let their partners enjoy the windfall. As Mason Jones from nodepositrewards.org put it, “I’m not sure if Minnesotans are being modest, independent, or just incredibly polite—maybe it’s all three!”

Taking Risks: Who’s Betting on a Million?

When asked if they’d gamble their million, responses varied from high-risk takers to those who wouldn’t even think about betting their newfound wealth.

Most Likely to Gamble: Virginia (97% Yes)

In Virginia, 97% would take a chance on a bet. With a long history of horse racing and more recently, a growing casino scene, Virginians seem comfortable with a bit of risk. Perhaps it’s that adventurous spirit, or maybe they’re just keen on turning that million into something bigger. Either way, it looks like Virginians are willing to roll the dice.

Most Risk-Averse: Washington (94% No)

At the other end, Washington state is all about caution. With 94% saying they wouldn’t gamble their million, Washingtonians prefer to keep their money safe and sound. In a place where tech innovation and careful planning are prized, residents seem more inclined to choose stability over thrill-seeking. It’s possible they’d rather invest in something predictable than risk it on a roll of the dice.

This is a fascinating one for us, as our website data doesn’t really correlate, albeit we are looking at overall traffic, not placing a $1m bet!. We do have Virginia very high but Washington doesn’t rank as low. Funnily enough, New York are the ones not willing to take that risk! Nevada surprisingly also makes the list, which for a state that literally epitomises risk takers, is quite surprising. Maybe they’re just sick of having a bet and losing.

Is Money Important?

When asked about the importance of money, Americans were again split, though slightly more said they could do without it. Some view wealth as essential, while others see it as secondary to life’s other joys.

Most Money-Conscious: West Virginia (90% Yes)

In West Virginia, 90% said that money matters. Given the state’s economic challenges, this finding makes sense. For many West Virginians, a million dollars could mean a complete lifestyle change, offering a chance to escape financial stress. In a state where traditional industries have declined, financial security is seen as a necessity.

Least Money-Conscious: California (98% No)

Meanwhile, 98% of Californians said money isn’t all that important. In a state that’s all about lifestyle, experiences, and personal fulfillment, it’s not surprising that so many would prioritize other aspects of life. Californians seem to value the good life over a wealthy life. With beaches, national parks, and world-class entertainment, who has time to worry about money? How the other half live.

Would You Rather Be an Unhappy Billionaire or live a Happy Middle Class lifestyle?

Finally, we asked respondents to choose between happiness and extreme wealth. It’s a question that goes beyond money, touching on what really matters in life.

Billionaire: New Hampshire (96%)

In New Hampshire, 96% said they’d choose a billion-dollar fortune over happiness. The state’s motto, “Live Free or Die,” reflects a value system that prioritizes quality of life over financial gain so it is surprising to see these results.

Middle Class: Nebraska (94% No)

Nebraskans are also all about happiness, with 94% choosing contentment over a massive bank balance. It seems that in Nebraska, community, family, and personal fulfillment are what truly matter. The Heartland isn’t chasing billionaire status—they’re happy with a comfortable, meaningful life.

What This Says About America

Real-world events like inflation, the pandemic, and shifting job markets have all shaped how Americans think about money and happiness.

In states like West Virginia, where economic uncertainty is prevalent, people place a high value on financial security. For Californians, where lifestyle and experiences are prioritized, money seems to take a back seat. This survey shows that while wealth is important, it’s not the ultimate goal for everyone.

- Love and Money: The split between Colorado and Minnesota over whether to expect half highlights how differently Americans approach relationships. Some see financial partnership as essential, while others prefer to keep things separate. It’s a reminder that love and money don’t always go hand-in-hand, and that’s okay.

- Risk and Reward: Virginia’s willingness to gamble contrasts sharply with Washington’s caution. Where some see a windfall as a chance to take risks, others see it as a way to secure their future. These differences show how local cultures and industries influence attitudes toward risk.

- Happiness vs. Wealth: The choice of happiness over wealth in Nebraska reflects a shift in how Americans view success, however there are some states like New Hampshire where money is valued more than happiness. Even in a world that celebrates billionaires, there’s a growing sentiment that life’s greatest rewards can’t be measured in dollars but the majority of states would choose money over happiness.

This survey and study is not necessarily the views of the state on the whole, nor does it represent the views of NoDepositRewards.org.

For press enquiries please contact:

[email protected]

one-march.co.uk